Photo Copyright IQ INC.

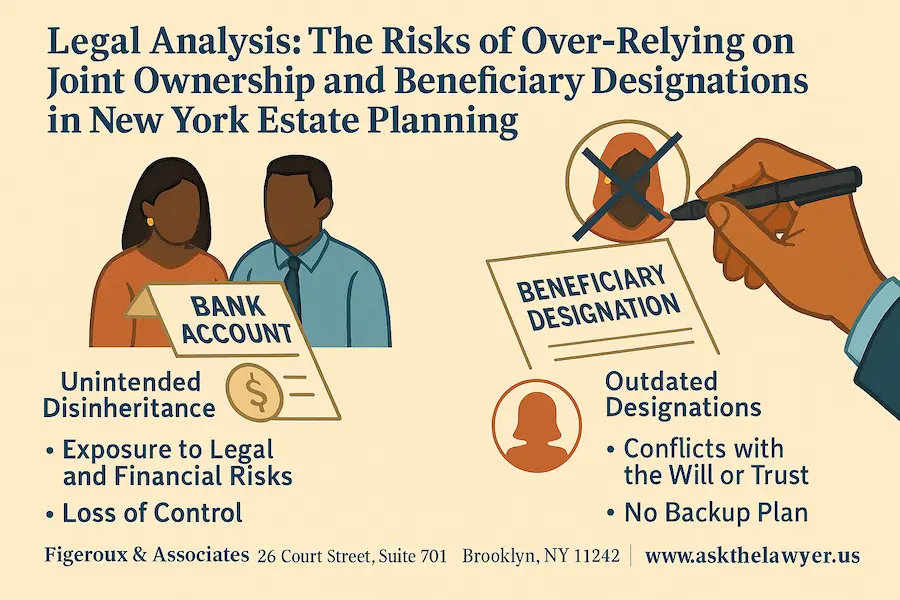

In New York, many people assume that listing a joint owner on a bank account or naming a beneficiary on a retirement plan is enough to handle their estate. While these tools are easy to set up, they’re often misused — and can lead to serious legal and financial consequences. At Figeroux & Associates, we regularly advise clients who believed they had a solid estate plan, only to find that their reliance on joint ownership or beneficiary designations created confusion, conflict, or unintended results.

The Appeal — and the Illusion — of Simplicity

Joint ownership and beneficiary designations are popular because they seem straightforward. Adding a child’s name to a bank account or naming a spouse on a life insurance policy appears to bypass probate and simplify inheritance.

But over-reliance on these tools — without a comprehensive will or trust — can backfire in several ways.

Consequences of Joint Ownership

- Unintended Disinheritance

If you name one child as joint owner of an account with the assumption they will “share” with siblings, the law doesn’t require them to do so. That child becomes the legal owner at your death — and siblings may be left with nothing unless they’re included in a valid will or trust.

- Exposure to Legal and Financial Risks

When you name someone as a joint owner, you give them immediate rights to the account. That means your assets can be exposed to their creditors, lawsuits, or divorce proceedings — even while you’re alive.

- Loss of Control

Adding someone to a deed or account can’t always be undone without their permission. You may lose control over your own property, especially if relationships change or the joint owner becomes uncooperative.

Consequences of Beneficiary Designations

- Outdated Designations

Many people forget to update their beneficiaries after a divorce, remarriage, or birth of new children. In New York, if your ex-spouse is still listed as your life insurance beneficiary, they may receive the proceeds — regardless of what your will says.

- Conflicts with the Will or Trust

Beneficiary designations override what’s written in your will or trust. If your estate plan leaves assets equally to all children, but one child is named on an account or insurance policy, the result can be an uneven — and potentially contested — distribution.

- No Backup Plan

If your named beneficiary dies before you and you haven’t updated the designation, that asset may wind up in probate anyway, defeating the very purpose of having named a beneficiary in the first place.

A Smarter, Safer Approach

At Figeroux & Associates, we believe in integrating beneficiary designations and joint ownership into a larger estate plan — not relying on them to carry the plan. We draft customized wills and trusts that coordinate all your assets, avoid unintended consequences, and provide clear guidance to your loved ones.

Call 855-768-8845 or visit www.askthelawyer.us today to schedule a consultation. Don’t let shortcuts sabotage your estate. Get the full protection your legacy deserves.

Click Here to Schedule a Consultation with Figeroux & Associates Today!